I recently got a co-branded Axis Bank credit card and I’m still learning about credit scores, CIBIL, and how to manage credit cards better. I’m a doctor by profession, currently studying for post-graduation, unmarried, and planning an international trip in November. I enjoy traveling and I’m also planning to buy a second car and a sub-500cc bike later this year.

I’ve used multiple credit cards before, and sometimes I just pay the minimum amount — but I’ve never missed a due date or delayed a payment. I also invest in mutual funds, stocks, and do a bit of trading. No major financial burdens as my parents are still working and financially independent.

Could you help me with:

-

How to improve my CIBIL score and manage my credit card usage better?

-

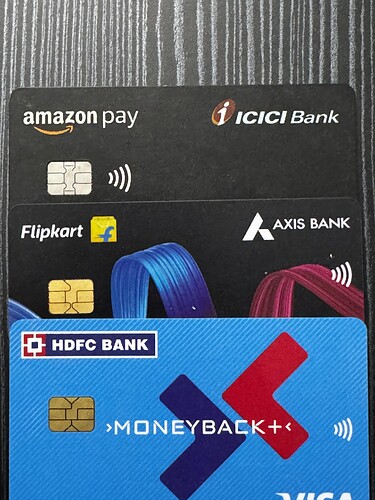

Whether my current card setup (including this Axis co-branded card) is the best fit for my lifestyle?

-

Any better credit cards from other banks (like HDFC, ICICI, SBI) that would suit my spending habits and travel plans?

-

Tips on maximizing benefits through EMIs, reward points, or lounge access, especially for frequent travelers?

Would really appreciate practical advice on which direction to take with my credit card journey."