Hi everyone,

I’m considering applying for the Amazon Pay ICICI Credit Card and would appreciate any insights or advice based on your experiences.

Here’s a quick overview of my financial background and what I’m looking for:

Personal & Financial Info

Personal & Financial Info

-

Age: 21

-

Employment Status: Employed

-

Monthly Income: ₹15,000

-

This would be my first credit card or loan.

Monthly Expenses

Monthly Expenses

-

₹10,000 – Support to family

-

₹3,000 – Recurring Deposits (RDs)

-

₹448 – Mobile bill

-

₹470 – Wi-Fi

-

Remaining balance – Personal/discretionary spending

Credit Card Preferences

Credit Card Preferences

-

No annual fee

-

No-cost EMI options

-

Cashback on Amazon purchases (non-Prime user)

-

Simple and beginner-friendly usage

-

No interest in lounge access

-

Priority on transparency and low fees

Why I’m Considering Amazon Pay ICICI Card

Why I’m Considering Amazon Pay ICICI Card

-

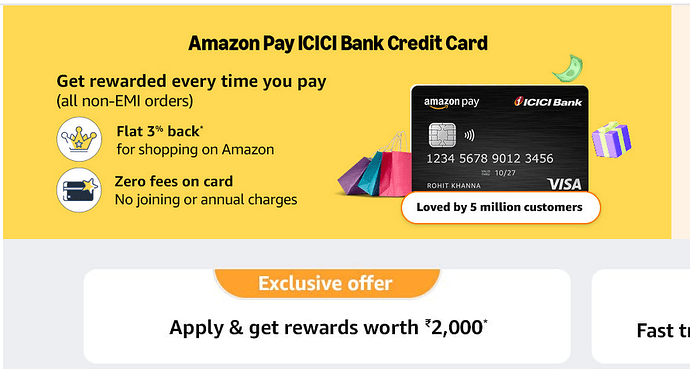

3% cashback on Amazon (for non-Prime members)

-

Easy EMI conversion for larger purchases

-

No annual or joining fee

-

Planning to use it primarily for Amazon and EMI spends

Questions for the Community

Questions for the Community

-

How do you manage card inactivity after a few months of use (e.g., after 6 months if I stop using it actively)?

-

Are there any hidden charges or fees I should be aware of, especially once the card becomes inactive?

-

Any tips or hacks to maximize cashback or benefits from this card?

Would love to hear your thoughts, tips, or red flags to watch out for. Thank you in advance!